競合に関連するインサイトを求めているときにも、顧客ロイヤリティーを高めたいときにも、抜群に役立つツールと言えば顧客フィードバックです。

なぜって?顧客フィードバックは、上手くいっている部分、間違っている部分を理解する力になり、改善に必要な情報を与えてくれるからです。けれど、顧客フィードバックの収集方法は1つではありません。具体的に言えば、フォーカスグループとアンケートのどちらを実施するか、選ぶ必要があります。

この判断をお手伝いするため、本稿ではフォーカスグループとアンケートのそれぞれの長所と短所、そして、顧客インサイトの収集場面に応じた使い分けについてご説明します。

フォーカスグループとは?

フォーカスグループを実施する調査者は、まず、特定のターゲット市場やユーザーペルソナ(ユーザー像)を代表する少人数の参加者を慎重に選びます。そして、フォーカスグループの最中には、質問を投げかけ、グループ参加者との話し合いを進行します。フォーカスグループは通常、双方向の会話で成り立つので、参加者が安心して本音を話せるよう、偏りのない中立的な環境を設けることが大切です。

とは言え、フォーカスグループから引き出すデータからは、顧客がどう考えているのか、なぜそのように考えているのかについて貴重なインサイトを得ることができます。市場のニーズに合わせた製品開発や、魅力的なマーケティングキャンペーンの実施、市場の変化への対応などで頼りになる調査手法です。

アンケートとは?

アンケートは、サンプル(標本)となる人々からフィードバックを収集するときに使われる調査方法です。フォーカスグループとは逆に、量的調査に分類されることが多く、確定的な結果を導き出すことができます。

予算や期間を非常に柔軟に設定できるのもアンケートのメリットです。ただし、一度配布し始めたアンケートにはできる限り変更を加えない方が良いので、そういう点では柔軟性に欠けると言えます。質問内容に一貫性がなければ正確なデータを収集できないからです。

フォーカスグループ VS. アンケート: どちらを使用すべき?

フォーカスグループかアンケートかを選ぶ前に、まずは調査課題を書き出しましょう。次に、それらの課題について次のように自問自答します。すなわち、調査を実施するために必要な情報の種類を考えるのです。

- 尋ねっぱなしの質問で満足のいく回答を得られるか、それとも対話形式にした方がよいか

- 詳しい事前説明が必要なコンセプトやユーザー体験をテストするか

- 参加者の反応を直接観察したいか

- 少数の意見を基に決定を下しても良いか

- 統計的に有意な結果を得るために、大きな標本サイズのフィードバックが必要か

顧客やターゲット市場と距離を縮めて意見を聞きたいなら、フォーカスグループが適しています。動機や喜びとなること、あるいは抱えている問題や課題に対面で耳を傾けることができます。このようなインサイトは、新しい製品やサービス、競争に関するヒントとなり、顧客の声(VOC)プログラムの強化にも使えます。

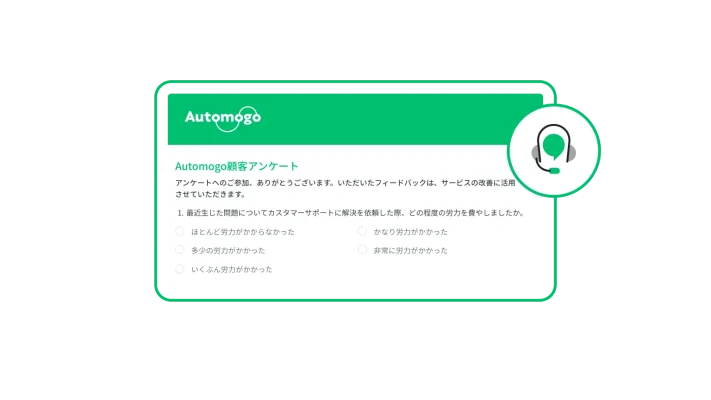

一方のアンケートは、特定のイベントと結びつけて実施することが多く、分析したデータを使って、組織の特定の側面にフォーカスした改善に役立てることができます。たとえば、サポートチームとやり取りしたすべての顧客にカスタマーサービスに関するフィードバックアンケートを送信します。収集したフィードバックを踏まえて、カスタマーサービスの主要な指標を追跡し、的を絞った改善を行いましょう。

フォーカスグループとアンケートの長所と短所

フォーカスグループとアンケートのどちらにすべきか、まだ決めきれませんか?そのような方のために、顧客調査や市場調査でどちらを使用するかを決める際に役立つリストをご用意しました。

フォーカスグループ

長所

- 顧客自身の言葉による顧客フィードバックに耳を傾ける

- 社内では思いつかなかった、顧客にとって重要なアイデアや課題を発見する

- 対話をしながら、問題をより深く掘り下げる柔軟性がある

- 個別にフォローアップ質問をして、顧客フィードバックの内容を明確にできる

短所

- 経費として、参加者の募集、会場・設備のレンタル、および進行役や代理業者にかかる費用、参加者への謝礼、グループを観察するための複数の場所への交通費などがかかる

- グループディスカッションで声の大きな参加者の意見に他の人が流されると、結果が偏る可能性がある

- 参加者に割いてもらう時間が長いため、適切な参加者を集めるのが難しい

- 計画、準備、募集、および(場合によっては)移動にかなりの時間と労力を費やす

アンケート

長所

短所

- 顧客調査や市場調査では、あらかじめ顧客の連絡先情報がないと、参加者の募集で行き詰まる可能性がある

- 顧客フィードバックの内容を明確にするためのフォローアップ質問ができない

- アンケートの質問に含まれていない問題について、参加者が自らフィードバックを提供する機会がない可能性がある

- アンケートの長さが重要なので、質問できる内容に制限がある。アンケートが長くなると、回答者が最後まで丁寧に回答する可能性が減る

どちらの調査方法も、基本的な準備は同じです。

効果的なフォーカスグループとアンケートを実施する方法

1. 目標を設定する

アンケートを作成したり、フォーカスグループを実施したりする前に、調査の目標を設定する必要があります。目標は、次の行動に移るため、または決断を下すために、何をすべきかを判断する指針になります。

目標を1つまたは複数(多くしすぎないように!)設定することで、アンケートやフォーカスグループの質問に磨きをかけることができます。このひと手間で、アンケート回答者もフォーカスグループ参加者も、答えやすくなるでしょう。

目標を定めると、会社の目標や関連するKPIに沿った調査になっているかも確認できます。これについては、社内の主要な関係者の協力を仰ぎ、確実に役立つ情報を引き出す質問がそろっているかをチェックしてもらうのもいいでしょう。

2. 参加者を募る

アンケートまたはフォーカスグループに参加してもらいたいのは誰ですか?そして、これと同じくらい重要な問いとして、除外したいのは誰ですか?

参加者は調査になくてはならない存在です。年齢、性別、世帯収入、職業、居住地などのデモグラフィックスについて必要な条件を考えてみましょう。

絞った対象者の連絡先情報は手元にありますか?それとも、ターゲット市場の調査に使える調査パネルが必要ですか?回答者や参加者に、自社の製品または製品カテゴリーについて詳しく知っていてもらいたいですか?

アンケートに適した回答者を見つけるのに支援が必要なら、SurveyMonkey Audienceをご利用ください。あなたの希望に応じてほぼどのような回答者にもアンケートを送信できます。

3. フォーカスグループのディスカッションガイドを作成する

ディスカッションガイドは、モデレーターと呼ばれる進行役がフォーカスグループで使用する、台本のようなものです。会話の流れを示し、議論のペースを調整する役目があり、目標に沿って、すべての参加者に関与するための道しるべとなります。ディスカッションガイドを作成する前に、以下の点を検討してください。

- モデレーターにどのような質問をしてもらうか

- 参加者からの質問に答えるために、モデレーターがプロジェクトについて知っておくべきことは何か

- コンセプトや試作品をテストする場合、モデレーターが参加者に与えることのできる手がかりやヒントは何か

- 適切なフォローアップ質問をできるよう、調査の目標についてモデレーターが知っておくべきことは何か

あなたがモデレーターを務め、調査者が別にいる場合は、(組織の目標に沿った)フォーカスグループの目標と目的から始めます。質問の仕方が適切かどうか、トピックやタスクが多すぎてグループ参加者が疲れないかどうかも一緒に確認しましょう。

4. 良い質問を作る

アンケートを作成する場合は、以下のベストプラクティスに従って、適切な質問を作成し、アンケートでよくあるミスを防いでください。

- 誘導質問と多重質問を避ける

- 二重目的の質問をしない

- デリケートなアンケート質問をするときは十分注意する

- 明確でわかりやすい言葉を使う

- 適切な質問タイプを使う

目標を忘れず、常に指針にしてください。尋ねる質問は目標に沿って判断することができます。トランザクショナルアンケートかリレーショナルアンケートかを決めるときも、選択形式質問と自由形式質問の数のバランスを決めるときも、常に目標に立ち返って考えるのです。

以上を踏まえて、信頼できるアンケートや質問を作成する手間を少しでも省きたい場合は、SurveyMonkeyの専門家が作成したアンケートテンプレートをご利用ください。また、AI自動作成機能もお薦めです。プロンプトで指示するだけで、アンケートを丸々作成してくれます。

5. フォーカスグループ参加者に向けての準備を検討する

フォーカスグループでの会話を実りあるものにするため、参加者に向けて行う準備の内容も検討する必要があります。準備することで参加者は当日の内容をあらかじめ把握し、グループでの会話に安心して参加することができます。

参加者に向けての準備の例:

- フォーカスグループを実施する場所、開始時刻、所要時間を知らせる

- 話し合いのトピックを知らせる

- 機密保持契約を含む、規則やポリシーについて説明する

調査を始める前に参加者にしておいてもらうアクティビティーや課題はありますか?事前に電話するアポを取るかメールを送信して、参加者に知らせましょう。

6. 謝礼の予算を確保する

まずは、顧客である参加者にインセンティブを提供する長所と短所を比較検討してください。参加者が費やす時間に対して報酬を渡す場合は、どのくらい予算を費やすことができますか?長いアンケートや1時間以上かかるフォーカスグループの場合は、ギフトカードを渡すと良いかもしれません。

提供する金額は、慎重な検討を要する事項ですので、適当に決めてはいけません。額が高すぎると、条件を満たしていない人までアンケートに回答したり、フォーカスグループに参加したりする恐れがあります。逆に安すぎると、十分に考えて回答しようというモチベーションが高まらないことでしょう。

フォーカスグループとアンケートの比較のまとめ

原則として、方向性を示してくれるような顧客との対話を求めている場合は、フォーカスグループの実施をお勧めします。明確な質問があり、大規模な顧客グループ、あるいは複数の顧客グループに聞く必要がある場合は、アンケートが適しています。

実際の所、1つのプロジェクトに対して方法を1つだけに絞る必要はありません。アンケートとフォーカスグループから得た洞察は、互いに補い合うことができます。アンケートからは、結論を導くために必要な定量的データや統計的に有意な結果が得られます。一方のフォーカスグループは、データの背後にある理由を明らかにし、ターゲット市場や顧客の声を拾うことができます。

自信を持ってターゲット市場を調査する

フォーカスグループやアンケートを実施する準備はできましたか?SurveyMonkeyを利用すると、市場調査をさらにパワーアップさせることができます。広告や新しいコンセプトのテスト、ブランドの健全性の監視、競争力に関するインサイトの取得、その他幅広い調査に対応しています。ターゲット市場へのリーチに関する詳細もぜひご覧ください。

その他のリソースを見る

ブランド マーケティング マネージャー

ブランド マーケティング マネージャー向けのこのツールキットは、ターゲット層の理解、ブランドの成長、ROIの測定をサポートします。

SurveyMonkeyを活用する一流マーケターのサクセスストーリー

マーケティング向けSurveyMonkeyを使ってインサイトをマーケティング戦略に活用する方法をご覧ください。

今日の労働環境を理解して再構築するための職場のトレンド3選

職場のトレンド、ワークライフバランス、自宅勤務、リモートワークと出社勤務の違いに関する新たな調査

キャンペーンを成功させるマーケティングの4Pの活用法

4P(製品、価格、場所、プロモーション)をマスターし、4Pを使って結果を生むマーケティング戦略を立てる方法を見つけましょう。